santa clara county property tax due date

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local. When not received the county assessors office should be.

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

October 19 2020 at 1200 PM.

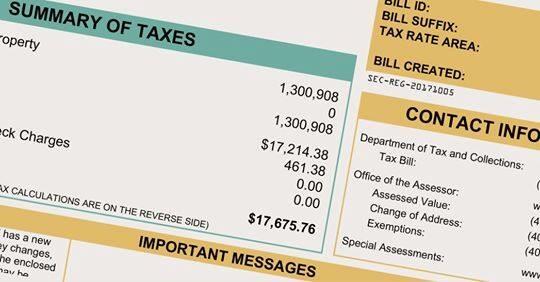

. Learn all about Santa Clara County real estate tax. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

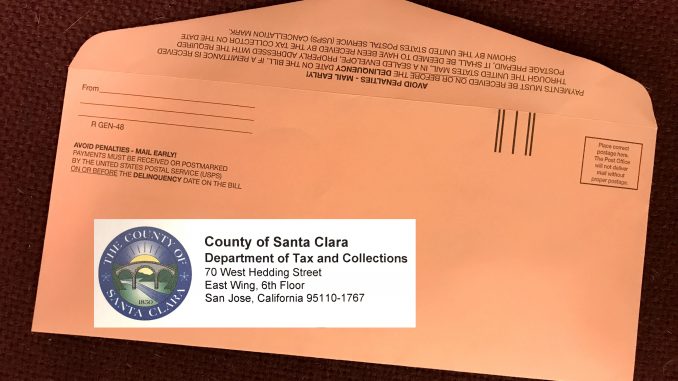

Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021. The bills will be available online to be viewedpaid on the same day.

Business Property Statements are due April 1. January 22 2022 at 1200 PM. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April.

If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the. SANTA CLARA COUNTY CALIF. The County of Santa Clara Department of Tax and Collections DTAC has mailed out the 2019-20 property tax bills to all property owners at.

SANTA CLARA COUNTY CALIF. The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the. SANTA CLARA COUNTY CALIF. The due date to file via mail e-filing or SDR remains the same.

When is the secured tax assessed. The Department of Tax and Collections in. The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the address shown on the tax roll.

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Sccaor Transaction Resource Center Santa Clara County Association Of Realtors

Coronavirus Tax Deadline Delay For Business Property May Hurt Schools Cities Assessor Warns Marin Independent Journal

Santa Clara County Al Twitter To Report A Non Essential Business Operating In Violation Of The Order To Shelter In Place Contact The County Of Santa Clara District Attorney S Office At Pubhealthreferral Dao Sccgov Org Leave

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Office Of The Assessor Facebook

Santa Clara County Can T Change When Property Taxes Are Due But It May Waive Late Fees San Jose Inside

Understanding California S Property Taxes

California Property Tax Calendar Escrow Of The West

First Installment Of The 2021 2022 Annual Secured Property Taxes Due By December 10 And Becomes Delinquent After 5 P M The Bay Area Review

Learn About Temporarily Lowering Your Tax Bill In Santa Clara County California Apartment Association

Prop 19 Property Tax And Transfer Rules To Change In 2021

28 451 93 Reasons We Made This Client Smile Shannon Snyder Cpas

Property Taxes Department Of Tax And Collections County Of Santa Clara

Industry News Invoke Tax Partners

Property Tax Appeal Deadlines Admiral Consulting

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates